In the first seven months of 2024, Europe’s steel market has seen notable shifts. Despite a 5% year-over-year increase in actual steel consumption in Q2, the forecast for the full year anticipates a 3% decline. Geopolitical tensions, inflation, market uncertainties, and elevated energy costs have contributed to high inventory levels in European steel mills, indicating demand remains softer than expected.

Import Dynamics

From the supply perspective, Europe’s total steel imports (including semi-finished products) fell by 2% year-over-year in Q2 of 2024 but increased by 12% compared to Q1. Notably, flat steel imports declined by 7% following a significant 22% rise in Q1, while long steel imports rose by 4% year-over-year, despite a 15% decrease from the previous quarter.

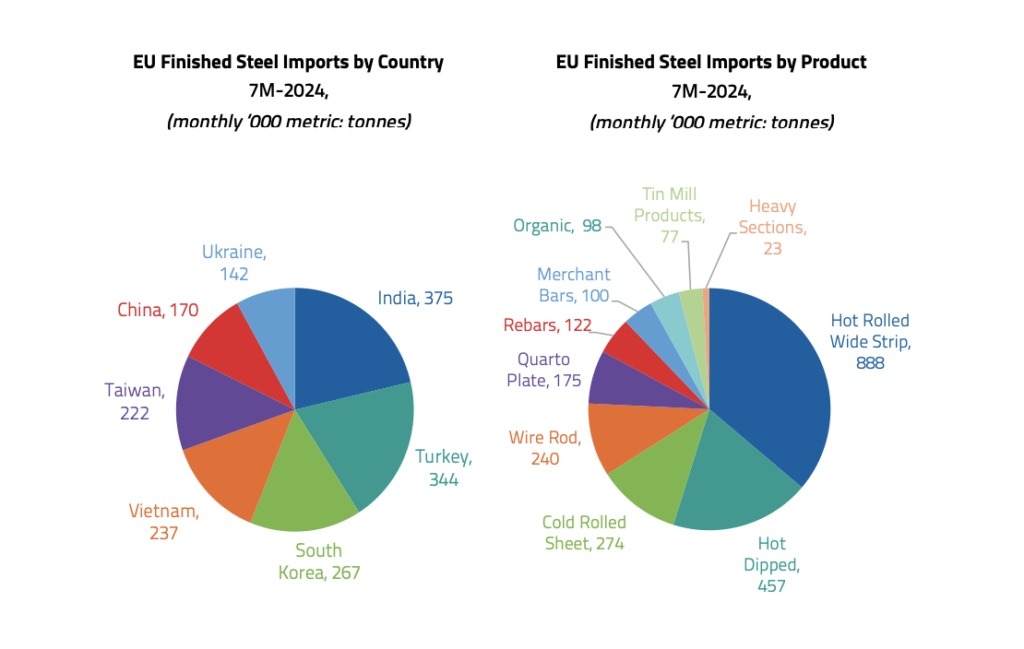

Key Sources of Steel Imports (Jan – Jul 2024):

- India – 15%

- Turkey – 14%

- South Korea – 11%

- Vietnam – 9.4%

- China Taiwan – 9%

- China Mainland – 7%

- Ukraine and Japan

Turkey stands out with a 99% surge in imports to Europe year-over-year, followed by India at 27% and Vietnam at 20%. In contrast, imports from China Mainland declined by 23%, from Japan by 20%, South Korea by 7%, and China Taiwan by 1%.

Product-Specific Trends

In terms of product categories:

- Flat Steel Products: European imports increased by 9% year-over-year for the first seven months.

- Long Steel Products: No change was observed, maintaining 20% of the total finished steel imports.

- Hot Rolled Wide Strip: Imports rose by 5%.

- Wire Rod and Rebar: Imports of hot-rolled coils and rebar grew by 13% and 20% year-over-year, respectively.

Outlook for 2025: Although demand remains muted for 2024, a recovery of around 3% is anticipated in 2025, provided economic stability and demand support from end-use industries materialize.