Oversupply and Import Pressure Weigh on the Market

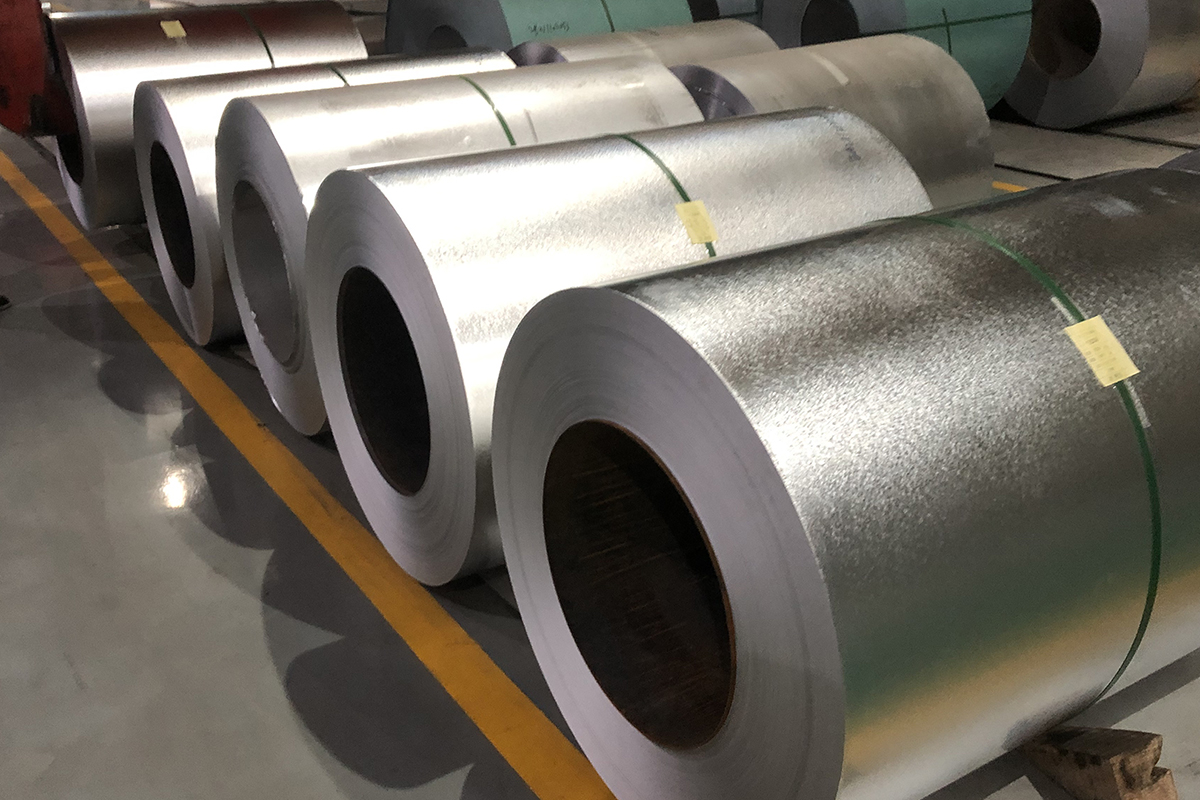

Indian domestic demand for hot-rolled coils (HRC) and cold-rolled coils (CRC) continues to remain sluggish due to oversupply and pressure from imports, according to Kallanish. Despite the Bharatiya Janata Party’s (BJP) significant victory in the Maharashtra state election, market sentiment has failed to improve. Traders note that no signs of recovery are visible in either the domestic or international markets.

Anticipation of Policy Clarity

The market awaits clarity on policy direction as Maharashtra forms its new government. Analysts expect the BJP’s win to lead to infrastructure and development project announcements, particularly in the western region of India. However, persistent challenges, including liquidity shortages, smog, and deteriorating air quality in northern India, are further exacerbating the demand weakness.

Price Movements and Import Trends

- HRC Prices: Slight drop of INR 250/tonne to INR 47,250-47,750/t ex-Mumbai.

- CRC Prices: Remain stable at INR 55,000-56,000/t ex-Mumbai.

- Import Activity: Chinese and Vietnamese imports are paused due to BIS license expirations, while Japan and South Korea maintain steady offers at $525-530/t CFR Mumbai.

Notably, products from Free Trade Agreement (FTA) countries like Japan, South Korea, and ASEAN nations are exempt from the additional 7.5% customs duty, giving them an edge over Chinese imports.

Looking Ahead

The Indian market continues to grapple with oversupply, influenced by new production facilities by JSW Steel and JSPL, and weakened export demand due to anti-dumping concerns in the EU. As uncertainties persist, market recovery will hinge on clear policy directions and improved domestic demand.